The West Lost Solar, Can We Win AI Hardware?

I believe the free world must maintain and expand it's lead in AI; controlling AI hardware may determine who prevails.

The US invented and commercialized both solar and integrated circuit technologies. Since then, China has surpassed the West in solar photovoltaic (PV) manufacturing, but Western countries lead in manufacturing the world's most advanced chips. What can we learn from the history of China surpassing the West in solar to preserve and expand our lead in AI compute?

Key Takeaways:

AI chips are strategic assets: China will use state power on strategic assets, Western nations should not lose out of conviction to free market competition. Between 2007-2015, China invested $50B+ in solar while Europe (the incumbent leader at the time) invested under $5B.

US policy should tighten export controls to limit tech transfers and critical chokepoints offer protection strategies: The manufacturing equipment to build both technologies is technically complex. Manufacturing equipment proved to be an important solar PV chokepoint. But Chinese companies simply purchased the best German solar PV manufacturing equipment available, instantly gaining technological parity that could be scaled.

Vertical integration may have consequences: vertical integration of the entire solar PV supply chain was capital intensive and meant less flexibility. Some critical manufacturing equipment is already developed in allied countries, America only needs to protect a few critical chokepoints.

Domestic competition is critical: competition prevents price and supply shocks that provide opportunity for new entrants.

Allied cooperation is critical: Western countries did not mount a unified response to China’s mercantilist solar policies. The US might not match China's semiconductor capacity, but the US, EU, Japan, Taiwan and South Korea combined vastly outproduce China in advanced chips and their inputs.

The Chinese state has spent billions of dollars building supercomputers, and is committed to indigenizing AI chip design and manufacturing. (source) According to RAND, advanced chips “drive the foundation of American strategic military advantage.”

The US pioneered solar technology, then state support via industrial policy and technology transfer and helped China scale past the rest of the world, an outcome we can avoid with AI hardware. While the two technologies both begin with the same raw material, sand, advanced semiconductors are far more technologically complex to manufacture than solar cells, so lessons are deserving of nuance and rigor.

The Role of State Support

Protectionism and state support define the history of solar manufacturing success. Competitors used policies like tariffs, subsidies and trade barriers, but governments often imposed tariffs too late. The center of solar manufacturing capacity experienced two major shifts: first, dominance shifted from the US to Germany and Japan in the early 2000s, and then from Germany/Japan to China in the 2010s.

In the 1980s, the US maintained 85% of the solar market, pioneered by companies like Bell Labs. During the Reagan administration, Japan and Germany emerged as new leaders due to massive subsidies. This coincided with a shift away from solar in the US as oil prices. This newly formed oligopoly’s subsidies came in the form of Feed-in tariffs, beginning in 2004, where governments guaranteed above market payments to anyone generating electricity from renewable sources. The policy wasn’t geopolitically targeted, so companies in the West and China sprung up to meet the demand.

Eventually, in the 2010s competition ensued between the newly formed Tokyo-Berlin oligopoly and China. China's modern state backing was historically unparalleled because solar was considered a strategic sector. Beginning in 2011 the state invested over $50B, more than 10x Europe's investment. (source) At the same time, Chinese industrial policy allowed access to cheap financing from state-owned banks, which extended at least $18B in low interest loans to solar companies by 2017. (source) According to Time, local governments routinely offered discounted land leases, or in some cases let solar farms or industrial parks operate rent free for years as an incentive.

Free markets deliver prosperity and low prices, but China will not play on an even playing field with strategic assets, nor should we. Even before the current AI boom, high performance computing (HPC) was a national priority. According to a joint report by the National Security Agency (NSA) and the National Nuclear Security Administration (NNSA), “National security requires the best computing available, and loss of leadership in HPC will severely compromise our national security. HPC plays a vital role in the design, development, or analysis of many—perhaps almost all—modern weapon systems and national security systems: e.g., nuclear weapons, cyber, ships, aircraft, encryption, missile defense, precision strike capability, and hypersonics.”

Technological Transfer

The acquisition of German manufacturing equipment and Western technological transfer served as a launching pad for Chinese dominance, and Western countries never used protectionist policies on the manufacturing equipment itself. Instead of export controls or nonproliferation agreements (e.g. the Wassenaar agreement covers semiconductor equipment exports), German suppliers actively facilitated transfers of equipment to Chinese firms, including entire German turnkey assembly lines. (source) In semiconductors, the Netherlands is home to ASML, which holds a virtual monopoly on extreme ultraviolet lithography (EUV) machines, the most critical piece of equipment in semiconductor manufacturing. Similarly, American companies like Applied Materials currently lead in semiconductor equipment for deposition and etching. The manufacturing equipment for semiconductors is vastly more complex, and requires more training and technical support, so they will be more difficult to recreate. EUV machines, for instance, require dozens of trained technicians at all times.

Massive state support and manufacturing equipment transfer coincided perfectly with a supply shock in polysilicon, a key component in solar cell manufacturing.

The Polysilicon Crisis

Around the 2008 financial crisis, a limited number of incumbent competitors in Japan, Germany, and the US meant unstable supply and prices. This combined with an explosion of demand from policies like feed-in tariffs, caused a supply shock in one of the key ingredients in solar cells: solar-grade polysilicon. A kilogram of solar-grade silicon that cost ~$25 in 2003 shot up above $300 per kg by 2007. At the time, a small handful of firms in Germany, Japan, South Korea and the US controlled the polysilicon market, while Chinese and Russian companies struggled to create silicon as pure.

But the price surge created an opportunity for new entrants. Chinese companies, with recent government support, seized the opportunity to catch up in the capital-intensive polysilicon manufacturing plants.

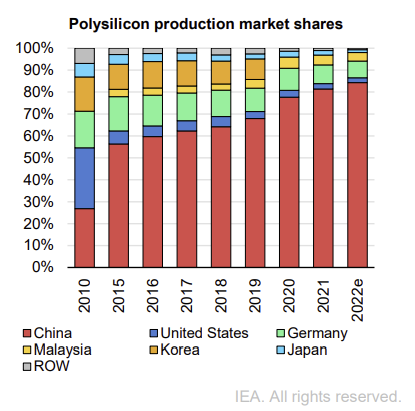

Polysilicon production market shares by country from 2010 to 2022 (source: IEA)

An oligopoly on polysilicon production made for a sclerotic market in solar PV manufacturing, and harmed solar installations. Greater competition could help avoid price incentives for rivals. For AI hardware, domestic and allied competition (e.g. Intel, AMD, Google and European competitors) could keep prices and supplies in check.

Once Chinese production came online, the market shifted from scarcity to surplus. Prices for polysilicon dropped by ~80% in 2011. Chinese paranoia over Western pressure helped motivate a vertical integration strategy in China which included every stage of solar PV manufacturing, from refining polysilicon into wafers, creating cells, and assembling solar modules. Trade disputes by Western countries were too late, and the boom-bust cycle resulted in a decisive win for Chinese manufacturers. In May of 2012, the US imposed tariffs on Chinese firms for dumping polysilicon, a policy of selling products at a price lower than it costs to capture market share. However, this backfired as Chinese counter tariffs cut Western polysilicon production out of the new largest solar cell market. One analyst says that China is still dumping solar cells to undercut any remaining Western rivals, selling polysilicon for $5/kg while it costs $6/kg to produce.

Vertical Integration

Unlike solar, it’s less feasible for one country to fully integrate across all stages because the complexity, R&D and capital intensity are magnitudes higher. For instance, semiconductor grade silicon has to be ~1000x as pure as solar-grade silicon, a single EUV lithography machine costs ~$400M, and fabs cost well over $10B only to become deprecated in a few years time. Despite this, China is clearly trying to vertically integrate semiconductor manufacturing. If they fill enough gaps, they will become resilient to export controls.

Globalized Chokepoints

AI technology and its inputs are not just developed by American and Chinese companies. The supply chain is global but remains concentrated among Western powers. For example, Taiwan Semiconductor Manufacturing Company (TSMC) outperforms Western and Chinese rivals in advanced semiconductor manufacturing, while Dutch ASML leads the world in some of the key equipment enabling TSMC. The US may not be able to rival China’s manufacturing might alone; but with close allies considered (Taiwan, Germany, France, Japan, South Korea, etc.), the competition favors the West by far. Alliances and agreements will determine who leads.

Conclusion

China sees solar as a strategic asset and has successfully monopolized the manufacturing process. In a matter of years, state-backing, industrial policy, technology transfer and slow reactions led to a durable Chinese lead that rooted out all competition. We can study cases of China's manufacturing successes in order to preserve the West's AI compute lead. These two industries share important manufacturing similarities: both are capital intensive and have diverse supply chains requiring a range of expertise.

This is a cautionary tale; solar modules are important, but AI chips are critical. AI governance demands strategic foresight, and cutting edge technologies will be the deciders of the great power competition.